1 Min Explanation Current Assets Vs Current Liabilities Examples

Solved Current Assets Current Assets Contra Current Chegg While analyzing the balance sheet of a company it is important to know the difference between current assets and current liabilities. here the distinction is related to the age of assets and liabilities. Quick explanation & revision of the topic "difference between current assets and current liabilities". subscribe to learn from our quick & bite sized accounting tutorials and hit the like.

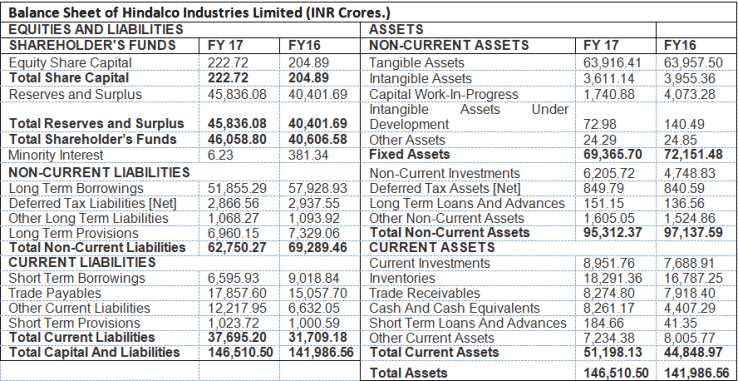

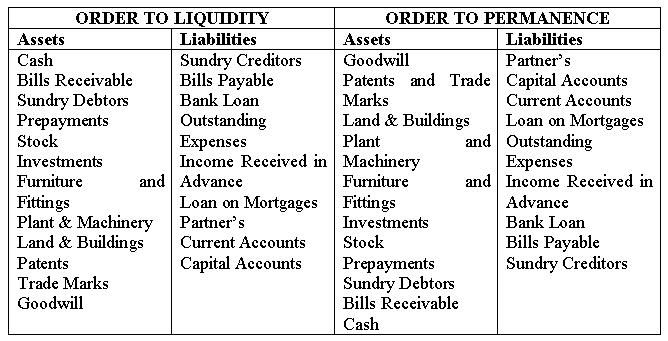

Assets Vs Liabilities Top 6 Differences With Infographics Current assets are any asset a company can convert to cash within a short time, usually one year. these assets are listed in the current assets account on a publicly traded company’s balance sheet. Understanding current assets and current liabilities is crucial for anyone looking to grasp the financial health of a business. have you ever wondered how companies manage their short term finances? by exploring these concepts, you’ll uncover the key elements that drive day to day operations. The current ratio measures a company's ability to pay its short term obligations and considers a company's total current assets relative to the current liabilities account, the value of. Current liabilities are typically settled using current assets, which are assets that are used up within one year. current assets include cash or accounts receivables, which is money owed by customers for sales.

Current Assets Vs Current Liabilities Learn The Key Differences The current ratio measures a company's ability to pay its short term obligations and considers a company's total current assets relative to the current liabilities account, the value of. Current liabilities are typically settled using current assets, which are assets that are used up within one year. current assets include cash or accounts receivables, which is money owed by customers for sales. In 2020 and 2022, the iasb published amendments to ias 1 to clarify the rules for classifying liabilities as current or non current. these amendments are effective from 1 january 2024. further details about these amendments are discussed in subsequent sections. This free textbook is an openstax resource written to increase student access to high quality, peer reviewed learning materials. One common measure is the current ratio, calculated by dividing current assets by current liabilities. a ratio above 1.0 indicates that a company has more current assets than current liabilities, suggesting it can cover its short term debts. The items classified under current assets and current liabilities also differ. as mentioned above, the latter usually include cash, inventory, and accounts receivable.

Solved What Are The Current Assets What Are The Total Chegg In 2020 and 2022, the iasb published amendments to ias 1 to clarify the rules for classifying liabilities as current or non current. these amendments are effective from 1 january 2024. further details about these amendments are discussed in subsequent sections. This free textbook is an openstax resource written to increase student access to high quality, peer reviewed learning materials. One common measure is the current ratio, calculated by dividing current assets by current liabilities. a ratio above 1.0 indicates that a company has more current assets than current liabilities, suggesting it can cover its short term debts. The items classified under current assets and current liabilities also differ. as mentioned above, the latter usually include cash, inventory, and accounts receivable.

What Are Current Assets And Current Liabilities Examples One common measure is the current ratio, calculated by dividing current assets by current liabilities. a ratio above 1.0 indicates that a company has more current assets than current liabilities, suggesting it can cover its short term debts. The items classified under current assets and current liabilities also differ. as mentioned above, the latter usually include cash, inventory, and accounts receivable.

Comments are closed.